This month Intuit gave us Release 5 (R5) for QuickBooks Desktop 2019. This is shortly after September’s Release 4 (R4) updates, with additions such as Cycle Counts, Pick, Pack, and Ship, and improvements to .iif file import. Read more about that in our last update.

The December 2018 R5 updates consist mainly of two bug issues that Intuit fixed that happened after downloading someone download the R4 updates. Let’s take a look at what R5 improvements and changes there have been.

Bug Fixes

- Crashing while applying credits to Invoice has been fixed.

- Error when closing QBA files if you have 2019 and lower QuickBooks version in the same PC has been fixed.

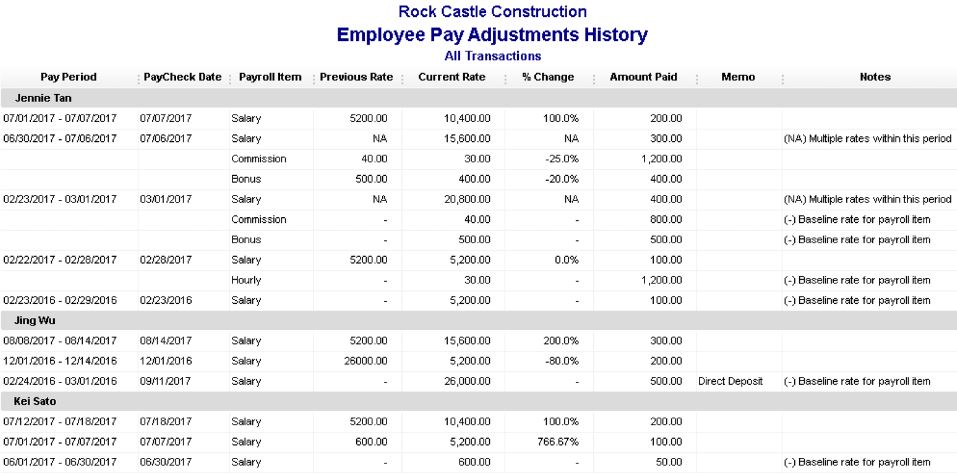

Payroll

Payroll Compliance

- QBDT Payroll products are completely compliant with US tax laws giving you complete confidence that you are paying your employees right.

Payroll reports

- You can now generate “State Mandated Retirement” reports for states that require reporting of retirements deductions from each employee’s paycheck.

Payroll Onboarding

- Purchasing Payroll in-product is now simpler and faster.

- After purchase, you can easily onboard to QuickBooks Desktop Payroll. With ‘Express Setup’ option, you can quickly add your employees, set up their pay and benefits and run your first payroll.

Other Changes

Fixed Asset Manager

- Update for calculations in order to support the Tax Cut and Jobs Act of 2017. This will be handy for tax season coming up!

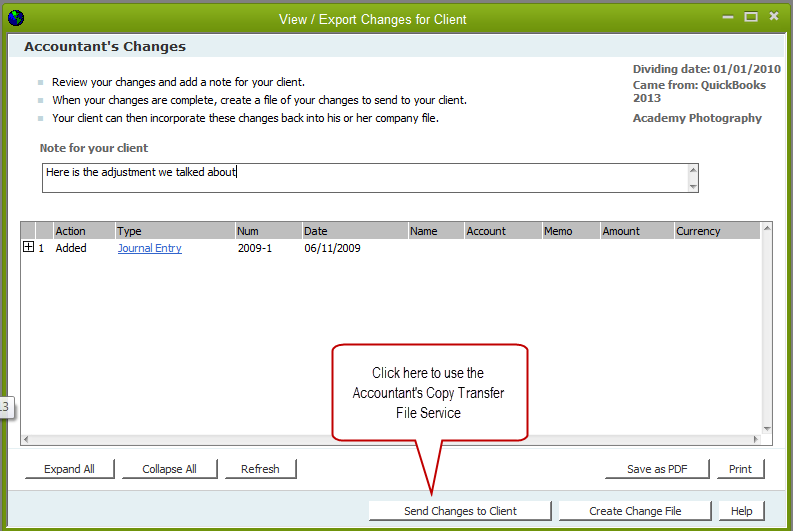

Accountant’s Copy File Transfer

- Improvements made to the ACFT experience for better collaboration with accountants.

Conclusion

We have really liked the updates and improvements that Intuit has made this year to QuickBooks Desktop. Many of these changes have made QuickBooks Desktop much more user-friendly, collaborative (like the addition of the Accountant Toolbox), and time-saving, such as with Cycle Counts and Pick, Pack, and Ship. We are excited to see what is in store for 2019.