Home » QuickBooks » QuickBooks Apps » QuickBooks Payroll

QuickBooks Payroll

Get the best pricing and expert guidance from Fourlane on QuickBooks Online Payroll and QuickBooks Desktop Payroll services. Contact us today for a free quote and product consultation.

Get a Free Quote

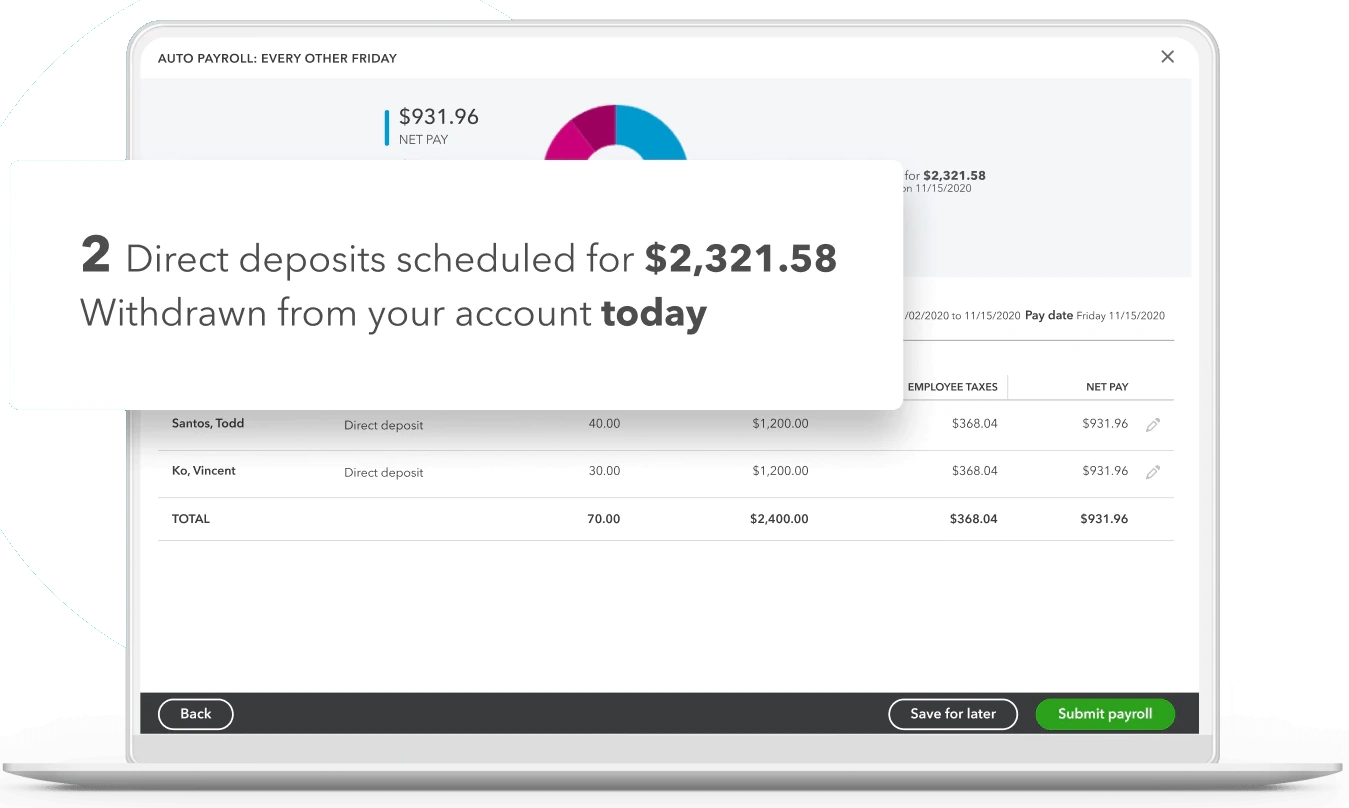

Auto Payroll

Free up your time when you set payroll to run automatically.

Same-day direct deposit

Hold onto cash longer and pay your team on your schedule.

24/7 expert support

Callback support means you’ll get answers anytime.**

QuickBooks Online Payroll Pricing

Sign up for QuickBooks Payroll through Fourlane and get extra savings on your subscription! Have multiple companies? Ask about our payroll solutions for larger businesses.

Core

30% off for 12 months-

Fast unlimited payroll runs

-

Calculate paychecks and taxes

-

Automated tax and forms

-

Workforce portal

-

Available in all 50 states

-

Manage garnishments and deductions

-

Payroll reports

-

Auto Payroll

-

1099 E-File & Pay

-

Expert product support

-

Next-day direct deposit

-

401(k) plans

-

Compare health care plans

-

-

-

-

-

Premium

30% off for 12 months-

Fast unlimited payroll runs

-

Calculate paychecks and taxes

-

Automated tax and forms

-

Workforce portal

-

Available in all 50 states

-

Manage garnishments and deductions

-

Payroll reports

-

Auto Payroll

-

1099 E-File & Pay

-

Expert product support

-

Same-day direct deposit

-

401(k) plans

-

Compare health care plans

-

Expert review

-

Track time on the go

-

HR support center

-

Workers’ comp administration

-

-

Elite

30% off for 12 months-

Fast unlimited payroll runs

-

Calculate paychecks and taxes

-

Automated tax and forms

-

Workforce portal

-

Available in all 50 states

-

Manage garnishments and deductions

-

Payroll reports

-

Auto Payroll

-

1099 E-File & Pay

-

Expert product support

-

Same-day direct deposit

-

401(k) plans

-

Compare health care plans

-

Expert setup

-

Track time and projects on the go

-

HR support center

-

Workers’ comp administration

-

24/7 expert product support

-

Tax Penalty Protection

-

Personal HR advisor

*QuickBooks Payroll discounts shown are good for the 1st year of your subscription.

QuickBooks Desktop Payroll Pricing

QuickBooks Desktop Payroll helps you simplify payroll with automated tax filings and improved cash flow control

Enhanced Payroll

for QuickBooks Desktop-

Pay W-2 employees and 1099s

-

Direct deposit

-

Automatic tax calculations

-

Electronically pay and file taxes, and W-2’s

-

Print W-2’s & forms for employees

-

Support from payroll experts included

-

Payroll done by you in QuickBooks

Assisted Payroll

for QuickBooks Desktop Enterprise-

Pay W-2 employees and 1099s

-

Direct deposit

-

Automatic tax calculations

-

Electronically pay and file taxes, and W-2’s

-

Print W-2’s & forms for employees

-

Support from payroll experts included

-

Payroll done for you by the experts

Fast, easy payroll

Time on your side

Set QuickBooks payroll to run automatically so you have more time to focus on your day-to-day.

Worry-free taxes

Intuit will calculate, file, and pay your federal and state payroll taxes for you.

Extra cash on hand

Hold onto your money longer when you pay your team with same-day direct deposit.

We don't just sell QuickBooks, we make it work for your specific business

Why Fourlane

Fourlane, the #1 Elite QuickBooks Solution Provider and Reseller, has helped thousands of clients with their financial systems, accounting software, and ERP system challenges. As industry and product experts for the most widely used accounting and ERP software solutions, we make sure our clients are buying the right software at the best price and recommend the best platform with a focus on our clients’ long term success.

“Fourlane’s broad expertise in all of Intuit’s products gives them the ability to provide exceptional service to QuickBooks’ users. As a QuickBooks Solution Provider, we count on solutions Fourlane provides to small- and mid-sized businesses all over the country.”

-Simon Pass, Intuit Reseller Program Sales Leader

Consulting and Advisory

We can help with every aspect of QuickBooks, including system design, inventory, business process, workflows, & more.

Data Conversion and Migration

With thousands of QuickBooks conversions, Fourlane is the most trusted company for converting your data to QuickBooks.

Setup and Implementation

Whether you need a simple QuickBooks install or a multi-user, cloud solution with external integrations, we can help.

Programming and Integration

Extend QuickBooks with custom apps and integrations, giving you a cost-effective alternative to more expensive ERP systems.

Reporting and Business Intelligence

Whether you need reports using the tools included in QuickBooks or a complex, custom-built, we’ve got you covered.

File Optimization and Review

From database stability to ledger tie-outs, our file review will give you an in-depth look into the health of your QuickBooks data.

Customized Product Training

We’ll create customized training and documentation specific to your business, processes, and industry.

QuickBooks Payroll business benefits

- Intuit helps 1.4 million businesses do payroll and file taxes.

- QuickBooks Payroll is the #1 payroll provider for small businesses.

- QuickBooks Payroll lets you view and approve employee hours and run payroll in less than 5 minutes.

- Over 97% of customers agree that QuickBooks Payroll increases confidence that payroll is accurate and compliant.

Manage HR and payroll in one place

Save time, stay compliant, grow your business, and pay your team. With QuickBooks Online Payroll, you can easily access resources or talk with an HR advisor by Mineral, Inc.**

8 out of 10 customers agree that onboarding new employees is faster and easier with QuickBooks Online Payroll than with their previous solution.²

Compare Online vs Desktop

Compare QuickBooks Online Payroll (Elite) vs QuickBooks Desktop Payroll (Assisted) plans

| Features | QuickBooks Online Elite Payroll | QuickBooks Desktop Assisted Payroll |

|---|---|---|

| Syncs with QuickBooks | ||

| Available in all 50 States | No (Not IN or WY) | |

| Federal Tax Payments & Filings | ||

| State Tax Forms Payments & Filings | (Not IN or WY) | |

| Local Tax Forms Payments & Filings | No | |

| Year-end W2s & 1099s | ||

| Employee & Contractor Self Setup | No | |

| Run Payroll Online | No | |

| Intuit Guarantee: Accurate Calculations | ||

| Tax Penalty Protection: Up to $25,000 | No | |

| Onboarding: Do it for Me | No | |

| General Payroll Support via Phone, Chat |  | |

| Pay Contractors & Employees via Direct Deposit | | Additional fee for Contractor Direct Deposits |

| Pay Day for Direct Deposit | Same Day submit payroll by 7am PST | Next Day submit payroll by 5pm day before |

| Allow Employees to View Paystubs Online | | |

| Online & Mobile Time Tracking | | No |

| Online Scheduling: By Shift or Project | | No |

| Online Geo-fencing for Time Tracking | | No |

| Human Resources Portal | | No |

| Connect with HR Advisor | | No |

| Optional Add-On: Health Benefits through Simplyinsured | | No |

| Optional Add-On: 401K through Guideline | | |

| Optional Add-On: Worker’s Comp through NEXT | | |

| Optional Add-On: Certified Payroll through Points North | | Basic reporting built-in |

Get the best pricing & expert guidance on QuickBooks Payroll

FAQs About QuickBooks Payroll

QuickBooks Payroll is a payroll management software offered by Intuit as part of the QuickBooks ecosystem. It helps businesses automate and streamline their payroll processes, including calculating wages, withholding taxes, generating paychecks, and filing payroll taxes.

QuickBooks Payroll comes in different versions to suit the needs of different businesses, including QuickBooks Online Payroll, QuickBooks Desktop Payroll (Basic, Enhanced, and Assisted), and QuickBooks Payroll for Accountants.

QuickBooks Payroll works by integrating seamlessly with QuickBooks accounting software, allowing users to manage payroll within the same system. Users can set up employees, enter hours, process payroll, and generate paychecks or direct deposits directly from QuickBooks.

Yes, QuickBooks Payroll can handle all aspects of payroll processing, including calculating employee wages, withholding taxes, generating paychecks, managing employee benefits, and filing payroll taxes.

Yes, QuickBooks Payroll supports direct deposit, allowing businesses to deposit employee wages directly into their bank accounts. This helps streamline the payroll process and eliminates the need for paper checks.

Yes, QuickBooks Payroll helps businesses stay compliant with payroll tax regulations by calculating and withholding the correct amount of taxes, generating tax forms (such as W-2s and 1099s), and filing payroll taxes electronically with federal and state agencies.

Yes, QuickBooks Payroll supports both employees and contractors. Users can set up and manage employee profiles with regular wages, taxes, and benefits, as well as contractor profiles for individuals who receive payments on a freelance or contract basis.

The level of assistance needed depends on the version of QuickBooks Payroll being used. QuickBooks Online Payroll and QuickBooks Desktop Payroll Basic allow users to run payroll on their own, while QuickBooks Desktop Payroll Enhanced and Assisted offer additional support and assistance from Intuit payroll experts.

Yes, QuickBooks Payroll offers mobile access through the QuickBooks mobile app, allowing users to manage payroll on the go from their smartphones or tablets. Users can view employee information, enter hours, run payroll, and generate paychecks from anywhere with an internet connection.